The Market Insights Other Buyers and Sellers Don't Have

Your free DFW Housing Market Insider Report

While most people are making six- and seven-figure real estate decisions based on outdated data and generic advice, you're about to see what's really happening in the North Texas market—and what it means for your next move.

Here's the problem with most market updates:

They tell you what happened 90 days ago. They lump all of DFW into one "market." They give you the same generic stats every agent is quoting.

But the DFW market isn't one market—it's multiple markets with dramatically different dynamics:

Entry-level homes: 3.5 months of supply (competitive)

Mid-market: 4.3 months (balanced)

Luxury: 11.2 months (strong buyer advantage)

And prices aren't moving the same direction everywhere. While headlines talk about "the market," savvy buyers and sellers are using segment-specific strategies that match current conditions.

Inside Your 34-Page Market Insider Report:

For Buyers:

✓ Which price segments give you negotiating leverage right now - Entry-level vs. luxury strategies are completely different

✓ The "3-Week Rule" that reveals motivated sellers

✓ Why price reductions are doing the negotiating work for you - 71% of listings have already cut prices

✓ Segment-specific buyer strategies based on months of supply in your range

For Sellers:

✓ The pricing framework that gets homes sold in 32 days vs. 90+

✓ Why timing matters more than you think - Q4 often provides better conditions than spring

✓ How to avoid becoming one of 10,000+ failed listings from Q3

✓ The truth about concessions - 50% of deals include them, here's how to plan

For Everyone:

✓ 90-day market forecast with specific predictions through year-end

✓ Hidden market indicators most agents miss - the patterns that signal shifts 60-90 days early

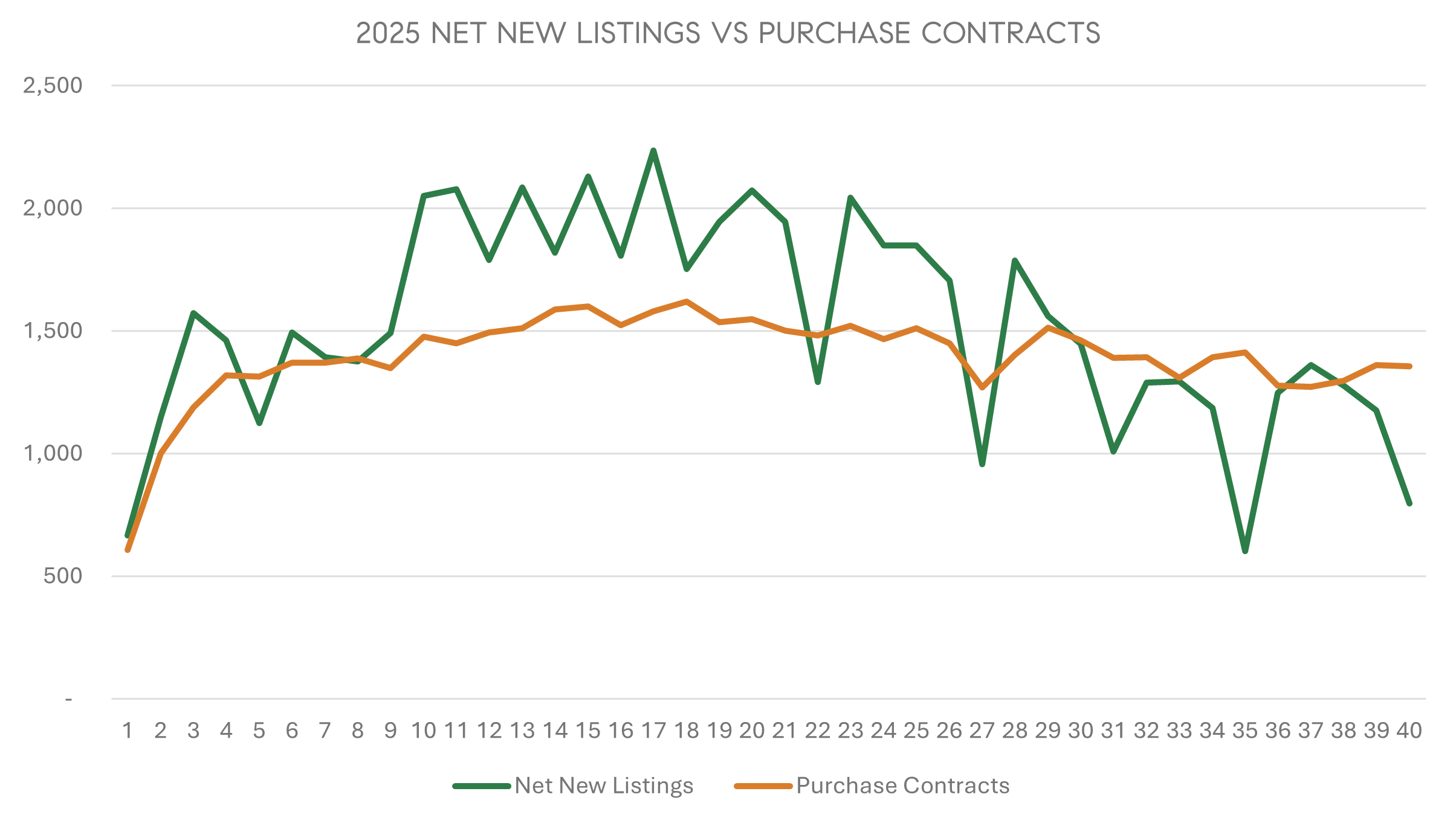

✓ Contract pricing trends that show where the market is heading (not where it's been)

✓ Actionable next steps based on your specific situation

The DFW market just crossed a critical threshold

For the first time in 2025, buyer contracts are consistently outpacing new listings - signaling a fundamental shift from the supply surge that defined Q2 and Q3. The 34-page report breaks down exactly what this means for different price segments and how to position yourself strategically.

Why This Analysis Is Different

This isn't a generic market update. It's the same intelligence I use to advise buyers competing for homes and sellers positioning properties in a shifting market.

Most agents report backward-looking data. This report shows you where the market is heading by analyzing:

Contract pricing - What's going under contract now at lower prices than closed sales

Inventory composition - 71% of listings already reduced, with median last cuts just 21 days ago

Segment divergence - Luxury vs. entry-level require completely different strategies

Failed listing trends - The shadow inventory building for 2026

Translation: You'll know what's coming 60-90 days before most people figure it out.

Here's What's At Stake:

If you're buying: Understanding segment dynamics and timing could save you tens of thousands and prevent you from overpaying in a market that's still finding its floor.

If you're selling: The gap between well-priced listings (selling in 32 days) and hope-priced listings (extending to 90+ days with multiple cuts) is widening. Properties that enter the market correctly still command premium prices.

If you're watching: The 2-3% adjustment through Q1 2026 represents the final phase of normalization—a rational entry or exit point if you understand the dynamics.

Get Your Free Market Intelligence Report

What happens next:

Enter your info below

Get instant access to download your 34-page report

(Optional) Schedule a brief call if you want to discuss your specific situation

📊 Updated with data through October 2025

🏠 Covering Dallas, Denton, Collin & Tarrant Counties

📈 34 pages of actionable market intelligence

Your information is never shared. This report is updated quarterly—you'll have the option to receive future editions.

About This Analysis

I'm Matt Haistings, a Broker Associate with Compass specializing in the DFW market. I created this report because I was tired of seeing buyers and sellers make major decisions based on generic market data that didn't reflect what was actually happening.

This analysis uses NTREIS MLS data combined with contract pricing trends, inventory composition analysis, and segment-specific dynamics to give you the complete picture—not just the headlines.

Questions? Call/text me at 469.305.0750 or email matt@haistingsre.com