The Plano Housing Market Outlook: 2026

Building on Stability

Executive Summary

Plano's 2026 Housing Market: Building on Stability

2025 delivered what sets Plano apart: As documented in our comprehensive 2025 Annual Report, while neighboring cities saw median prices decline—Frisco down $6,000, McKinney down $35,000, Celina down $90,000—Plano's median increased by $2,000. The only major Collin County city where prices rose year-over-year.

This wasn't luck. Minimal new construction, sustained corporate demand, and a resale-dominated market created structural advantages that neighboring growth cities couldn't replicate.

But 2026 introduces dynamics that will test whether this stability continues:

Key Market Forces:

Shadow Inventory: 616 properties that withdrew in 2025 represent 3.2 months of sales volume waiting on the sidelines

New Construction Pipeline: Collin Creek, Willow Bend, and Haggard Farms could add ~500 homes—a 22% inventory increase

Interest Rate Reality: Projected decline to ~6% by year-end saves $150/month but doesn't fundamentally shift buyer pools

Pricing Precision: Properties priced right on day one achieved 100% of asking. Those that lingered 90+ days sold for 90%—a $54,000 difference on Plano's median home

2026 Price Outlook by Tier:

| Segment | Forecast | Key Dynamic |

|---|---|---|

| Entry-Level (<$400K) | +1-2% | Shrinking supply, no new construction serving this tier |

| Mid-Market ($400K-$750K) | 0-2% | New construction competition, shadow inventory returns |

| High-End ($750K-$1.5M) | Stable to +2% | Limited supply, sustained corporate demand |

| Luxury ($1.5M+) | Property-Specific | Micro-market efficiency, 22 DOM in 2025 |

Strategic Realities:

Success in 2026 comes from understanding five critical market dimensions: price dynamics and what drives them, interest rates and affordability beyond the headlines, seasonal timing and the competition-versus-exposure trade-off, geographic competition and how East/Central/West Plano compete differently, and seller strategy that rewards pricing discipline over market speculation.

The question isn't whether Plano remains strong—the structural advantages that drove 2025's stability persist. The question is how buyers and sellers navigate a market where advantage requires precision, not hope.

Market intelligence, not market cheerleading. Let's start with prices.

Why Plano Didn't Decline—And What That Means for 2026

While Frisco dropped $6,000, McKinney fell $35,000, and Celina plummeted $90,000 in 2025, Plano's median price increased by $2,000. This wasn't luck—it was structural advantage.

The difference? New construction. Neighboring cities saw builders continue to flood the market with inventory, then shift to lower-priced product lines as demand softened. Those lower-priced new homes dragged down median prices across entire cities. Plano, with just 19 new construction sales (<1% of market), avoided this dynamic entirely. A resale-dominated market maintains pricing stability that growth-mode suburbs can't replicate.

Corporate stability reinforces this advantage. AT&T's decision to relocate its global headquarters to the former EDS campus in Legacy further anchors West Plano's premium positioning—a different dynamic than suburban growth cities betting on future relocations.

But 2026 introduces new variables that will test whether Plano's stability continues.

The Shadow Inventory Question

Will Plano home prices drop when withdrawn listings return?

616 properties came to market in 2025 but chose to sit out rather than adjust to pricing reality. That represents 3.2 months of normal sales volume currently on the sidelines.

The 2025 data on failed listings shows what happens next: 29% of properties that initially failed adapted through price adjustments, timing changes, or improvements—and found success. The other 71% are still waiting. If they return in 2026 without resetting expectations, they'll face the same outcome while competing with both normal inventory and each other.

Shadow inventory creates opportunity for strategic sellers. While hundreds of properties wait for conditions to change, well-priced homes continue moving. The market rewards current value, not hopeful pricing.

New Construction Reality Check

Will new construction in Plano lower home prices in 2026?

Collin Creek, Willow Bend redevelopment, and Haggard Farms represent the majority of Plano's development pipeline—roughly 500 single-family homes if everything delivers in 2026. Against Plano's 2,297 sales in 2025, that's a 22% inventory increase. Material, but not catastrophic.

Two important nuances temper this impact:

First, much of Plano's "new construction" labeled as single family is actually townhomes—which compete in a different buyer segment than traditional single-family resale. A buyer evaluating a $650,000 established home in Whiffletree versus a $550,000 Collin Creek townhome is making a lifestyle decision—traditional single-family living with established neighborhood character versus new construction with lower maintenance and modern finishes. These segments overlap in budget but serve different preferences.

Second, new construction in Plano typically prices above area medians, not below. The 19 new homes that sold in 2025 carried a median price of $545,990—right at Plano's overall median. Unlike neighboring cities where builders chase volume with cheaper product, Plano's limited land pushes new construction toward premium positioning.

The real pressure point? Central Plano's mid-market tier ($400K-$750K), where new inventory will be most concentrated. Established resale properties in this range will need to compete on condition, location, and value—not just list price.

2026 Price Forecast by Tier

Entry-Level (<$400K): +1-2%

This segment continues shrinking—down to just 20% of sales in 2025 from 60% in 2020. No meaningful new construction serves this price point, and existing inventory remains constrained. First-time buyers increasingly need $400K+ to access Plano, which maintains upward pressure on the limited sub-$400K stock that exists.

Mid-Market ($400K-$750K): 0-2%

Where new construction impact concentrates. The 60% of Plano's market in this tier will see the most competition from new inventory. Well-positioned resale homes—great locations, excellent condition, realistic pricing—will perform. Dated properties priced like their updated neighbors will struggle. This is where the 616 shadow inventory properties will compete most directly.

High-End ($750K-$1.5M): Stable to +2%

Limited supply meets sustained corporate relocation demand. Median sold price in this tier was $875,000 in 2025—not $750,000—meaning buyers need $850K-$900K to access typical inventory. New construction here is minimal, and West Plano's established luxury neighborhoods maintain pricing power through location and maturity.

Luxury ($1.5M+): Property-Specific

The 61 sales above $1.5M in 2025 (median: $2.2M, 22 DOM) demonstrate micro-market efficiency. At this tier, pricing depends on individual property attributes—location, condition, uniqueness—not citywide trends. Well-positioned luxury continues moving quickly; overpriced luxury sits regardless of market conditions.

Matt's Take:

Plano's 2025 stability came from constrained supply meeting sustained demand—not market momentum. The 22% potential inventory increase from new construction is material but manageable in a market with 75,000+ existing homes and ongoing corporate relocations. The bigger risk for sellers isn't new construction—it's the properties sitting on the sidelines who think waiting for 'better conditions' is a strategy. Markets don't reward patience. They reward pricing discipline.

Plano's pricing stability reflects structural advantages that persist into 2026. But pricing is only half the affordability equation—the other half is what buyers can finance. And that's where the real 2026 questions emerge.

Interest Rates & Affordability—Beyond the Headlines

The Rate Reality Check

Everyone's waiting for rates to drop. Here's what actually happens when they do.

Current mortgage rates hover around 6.5-7%. Compass's 2026 Housing Market Outlook projects gradual decline toward 6% by year-end 2026, driven by expected Federal Reserve policy adjustments. On a $540,000 Plano median home, that half-point reduction saves roughly $150 per month. Meaningful for budgets, yes—but not the market transformation most buyers expect.

The math that matters: A 0.5% rate drop doesn't fundamentally change who can afford to buy in Plano. It improves monthly cash flow for those already qualified, but it doesn't open the market to an entirely new buyer pool the way a drop from 6.5% to 4.5% would.

What History Actually Shows

Should I wait for interest rates to drop before buying in Plano?

Pull up any chart of Plano's sales volume against prevailing mortgage rates over the past decade, and you'll see something surprising: weak correlation. Despite rates remaining elevated in the 6-7% range throughout 2025, Plano closed 2,297 sales—the strongest year documented in our Annual Report, exceeding both 2024 and 2023. The 2021-2022 spike wasn't driven only by low rates—it was pandemic disruption, stimulus money, and relocation acceleration all hitting simultaneously.

Volume drops when rates change dramatically and quickly—the 3% to 7% jump of 2022-2023 shocked buyers out of the market. But sustained rates at any level tend to normalize. Buyers adjust expectations, recalibrate budgets, and transact based on life circumstances rather than rate optimization.

The 2025 data proves this pattern. Despite rates remaining elevated in the 6-7% range all year, Plano closed 2,297 sales—the strongest year since the pandemic. Buyers who needed to move for jobs, growing families, or life changes didn't wait for perfect rate conditions. They worked with the market that existed.

The Affordability Threshold

Here's the framework that matters more than rate speculation:

Median Plano home: $540,000

At 6.5% with 20% down: ~$160,000 household income required

At 6.0% with 20% down: ~$150,000 household income required

That $10,000 income threshold shift is material for households right on the qualifying edge—but it's not creating massive new buyer pools. The buyers who can afford $540,000 at 6% could mostly afford it at 6.5% with slightly tighter budgets.

The real affordability constraint in Plano isn't rates—it's the price floor. Entry-level buyers discover they need $400,000+ to access the market, which requires ~$120,000 household income even at 6% rates. A couple earning $100,000 combined doesn't get meaningfully more access to Plano whether rates are 6.5% or 6%. They're priced out by the market itself, not the financing cost.

The Waiting Cost

| Interest Rate | $400,000 | $540,000 | $725,000 |

|---|---|---|---|

| 6.50% | $2,023 | $2,731 | $3,666 |

| 6% | $1,919 | $2,590 | $3,477 |

| 5.50% | $1,817 | $2,453 | $3,293 |

Monthly principal and interest payment by home price and interest rate | 20% down payment assumed

Will lower interest rates cause Plano home prices to increase?

Here's the trap: Waiting for rates to drop 0.5% while prices rise 2-3% is negative arbitrage.

Run the actual numbers on a $540,000 home:

Scenario A: Buy today at 6.5%

Monthly payment: ~$2,730

Scenario B: Wait 6 months, rates drop to 6%, but price rises to $555,000 (+3%)

Monthly payment: ~$2,665

You save $65 per month but paid $15,000 more for the house. At that payment savings rate, it takes 230 months (19 years) to break even on the higher purchase price. And you spent six months renting instead of building equity.

And that assumes prices only rise 3%. If Plano's constrained supply pushes appreciation to 4-5%, waiting becomes even more costly.

The math changes if rates drop significantly—say to 5.5% or below. That creates genuine payment relief and might justify waiting if you believe prices will stay flat. But modest rate drops (0.5-1%) combined with even modest appreciation (2-3%) almost always favor buying when you're ready rather than timing the bottom. And, by the way, the bottom of this pricing cycle was 2015; we're not going back to that level.

Strategic Rate Thinking for 2026

Rates will matter for 2026's market dynamics, but not the way most people expect:

Modest drops (6.5% → 6%): Slight demand increase, absorbed by normal market. Not transformative.

Significant drops (to 5.5% or below): Would bring meaningfully more buyers, creating competition and upward price pressure. The very rate drop you waited for could cost you more through bidding wars on the most coveted houses.

Sustained high rates (6.5%+): Market continues functioning, buyers adjust expectations, life-driven purchases persist. Plano's 2025 proved this works.

The strategic insight: Use rates as one input among many—job changes, family growth, market inventory, personal finances—but don't let rate speculation drive timing decisions. Buy when your circumstances align and the right property appears, not when rates hit an arbitrary target.

The "Hidden" Affordability Lever: Seller Concessions

If modest rate drops won't fundamentally shift affordability, what will? The answer is already operating in plain sight—and it's funded by negotiation, not monetary policy.

While headline rates stayed elevated in 2025, the effective rate many Plano buyers paid was lower—thanks to seller-funded rate buydowns.

Seller concessions climbed significantly: 51% of Plano sales in 2025 included concessions averaging $6,000 (up from 43% in 2023 at $5,000). But the strategic shift isn't just the frequency—it's how buyers are using these credits.

Instead of negotiating purely on sales price, savvy buyers are requesting sellers fund temporary or permanent rate buydowns. A $10,000 seller credit can buy down a 6.5% rate to 5.75% for two years or reduce it permanently by 0.25-0.375%. This "manufactures" affordability without the seller slashing their asking price—creating a win-win in a rate-sensitive market.

The practical impact:

On a $540,000 home at 6.5%, a 2-1 buydown (5.5% Year 1, 6% Year 2, 6.5% thereafter) costs the seller roughly $8,500 but saves the buyer ~$275/month in Year 1 and ~$135/month in Year 2. For a household right on the qualifying threshold, this temporary payment relief can be the difference between approval and rejection.

Even properties selling quickly (0-7 days DOM) included concessions 47% of the time in 2025, though amounts were lower ($4,250 vs. $6,000+ for extended DOM properties). This isn't just a tool for struggling listings—it's become standard market practice.

For 2026 strategy:

Buyers: Don't fixate solely on rate drops. A well-negotiated seller concession delivers immediate payment relief while preserving your ability to refinance later if rates do decline significantly.

Sellers: Budget 1-2% of sale price for concessions when planning your net proceeds. Offering rate buydown assistance proactively can differentiate your listing and accelerate the sale without cutting asking price. (We'll cover this in detail in the Seller Strategy section.)

The irony? While everyone waits for the Fed to lower rates, the market has already created its own solution—funded by negotiation, not monetary policy.

Matt's Take:

I've watched buyers sit on the sidelines for two years waiting for 'better rates.' Meanwhile, they've paid $60,000 in rent instead of building equity, and the homes they were considering are now more expensive. The buyers who closed in 2024-2025 can refinance if rates drop meaningfully. The buyers who waited can't buy back the equity they missed. Rates matter—but timing your life around them rarely works.

Understanding affordability dynamics—rates, concessions, the waiting cost—answers whether to buy or sell. But it doesn't answer when. For that, we need to examine how Plano's market performs across the calendar year.

Seasonality & Timing—When Strategy Matters

The 2025 Pattern Break

Conventional wisdom says spring dominates real estate, summer sustains it, and winter kills it. 2025 proved otherwise.

New listings exceeded historical averages in 11 of 12 months—a sustained supply surge unlike any year in the past decade. Yet monthly closings varied by only 7 percentage points (6%-13% of annual volume). Buyer demand remained remarkably stable year-round while seller competition intensified seasonally.

The Spring Paradox captured this disconnect perfectly. May 2025 brought 458 new listings to market—the year's peak. But only 194 homes closed the following month, a 2.4:1 ratio of new supply to absorption. Spring delivered maximum buyer traffic and maximum seller competition. Properties priced correctly moved. Those testing the market with optimistic pricing faced months of inventory accumulation around them.

The Competition vs. Exposure Trade-Off

When is the best time of year to list a house in Plano?

The answer depends on what you're optimizing for.

Spring (March-May) offers maximum exposure:

Most buyer traffic of the year

Corporate relocations accelerate

Families shopping before school year ends

Weather favors showings and curb appeal

But spring also brings maximum competition:

More listings than any other season

Your home competes with the best inventory sellers have been preparing all winter

Buyers have abundant alternatives, reducing urgency

Price reductions become common when supply outpaces demand

The math matters: Would you rather compete with 100 buyers among 150 homes, or 75 buyers among 50 homes? Spring gives you the former. Fall/winter gives you the latter.

Strategic Windows for 2026

Q1 (January-March): The First-Mover Advantage

Listings in Q1 face minimal competition—inventory is at annual lows as most sellers wait for spring. Yet buyer demand remains strong, driven by year-end job changes, completed holiday travel, and new-year financial planning.

Best for: Sellers who can prepare homes during winter. Properties that show well regardless of season (great bones, updated interiors, professional staging).

Consider if: Your home doesn't depend on outdoor appeal (pool, extensive landscaping), or you can invest in making it show-ready during cold months.

Q2 (April-June): Maximum Exposure, Maximum Competition

The traditional peak. More buyers, more showings, more offers—but also more inventory. May 2025 alone brought 458 new listings to market—40% above historical averages for the month.

Best for: Pristine properties in high-demand neighborhoods. Homes that compete on condition and location, not price. Sellers who need the absolute maximum buyer pool to find their specific buyer.

Consider if: You're willing to be patient and selective. Spring buyers browse more than winter buyers buy. DOM extends unless you're priced perfectly.

Q3 (July-September): Serious Buyers Remain

Inventory declines as failed spring listings withdraw. Families with school-age children face urgency to close before the school year starts. Buyers active in summer heat are motivated by circumstance, not convenience.

Best for: Sellers who missed spring timing or had life changes mid-year. Properties near good schools (families prioritize location over perfection when timing is tight).

Consider if: You can position your home as the "beat the school year deadline" solution. These buyers trade exhaustive shopping for decisive action.

Q4 (October-December): Lowest Competition

Just 50% of normal inventory. Buyers active during holidays are serious—job relocations, life changes, or investment purchases that don't wait for "better timing." Fewer showings, but higher conversion rates.

Best for: Sellers who can be flexible on closing dates (buyers may want to close after holidays). Properties that show well indoors (great layouts, updated kitchens, cozy feel). Motivated sellers willing to work with motivated buyers.

Consider if: You value serious buyers over maximum traffic. Winter buyers don't browse—they buy.

What the Data Actually Says

What month do Plano homes sell fastest?

Looking at post-pandemic market patterns (2023-2025), the seasonal advantage is clear: homes listed in Q1 sell fastest and at the highest percentage of asking price.

Median days on market by list month (2023-2025 data, sold properties only). Properties listed in Q1 averaged 8-14 days on market, while summer/fall listings averaged 20-26 days—nearly double the market time.

Properties listed in January through March averaged just 8-14 days on market before going under contract. By contrast, summer and fall listings (June through November) averaged 20-26 days—nearly double the market time.

Median sold price as percentage of original list price by list month (2023-2025 data, sold properties only). Q1 listings achieved 98.7-99.9% of asking price, while summer/fall listings settled at 96.8-97.5%—a difference of $10,800-$16,200 on a $540,000 home.

Negotiating power follows the same pattern. Q1 listings achieved 98.7-99.9% of original asking price, while summer/fall listings settled at 96.8-97.5%. That 2-3% difference represents $10,800-$16,200 on a $540,000 home.

The advantage compounds: Q1 sellers get more of their asking price and spend less time on market. Summer/fall sellers face both longer market time and deeper price negotiations.

The Strategic Takeaway

Timing creates measurable but not transformative advantages. The seasonal spread—8 days DOM in March versus 26 days in September, or 99% of asking versus 97%—is material but manageable.

If you have flexibility:

Q1 (Jan-Mar) offers fastest absorption and highest sold-to-list ratios

Q4 (Oct-Dec) provides less seller competition than spring/summer

Q2 (Apr-Jun) maximizes buyer pool but intensifies competition

Q3 (Jul-Sep) targets motivated buyers with timing pressure

If you don't have flexibility:

List when you're ready and price aggressively for the competition level that exists. A well-priced home in July outperforms an overpriced home in April. The data shows homes sold year-round—timing matters, but pricing precision matters more.

Matt's Take:

Sellers obsess over timing because it feels controllable. What month should I list? Should I wait for spring? The 2023-2025 data shows timing matters far less than everyone thinks. Yes, spring brings more buyers—but it also brings more competition. I'd rather list a well-prepared home in January against 30 competing properties than list in May against 120. The market functions year-round now. Timing is marginal. Pricing is everything.

Timing creates measurable advantages, but geography determines your actual competition. A well-priced home in East Plano doesn't compete with West Plano luxury—it competes with Allen and McKinney. Understanding where you sit in Plano's three distinct markets shapes everything from pricing to buyer pool expectations.

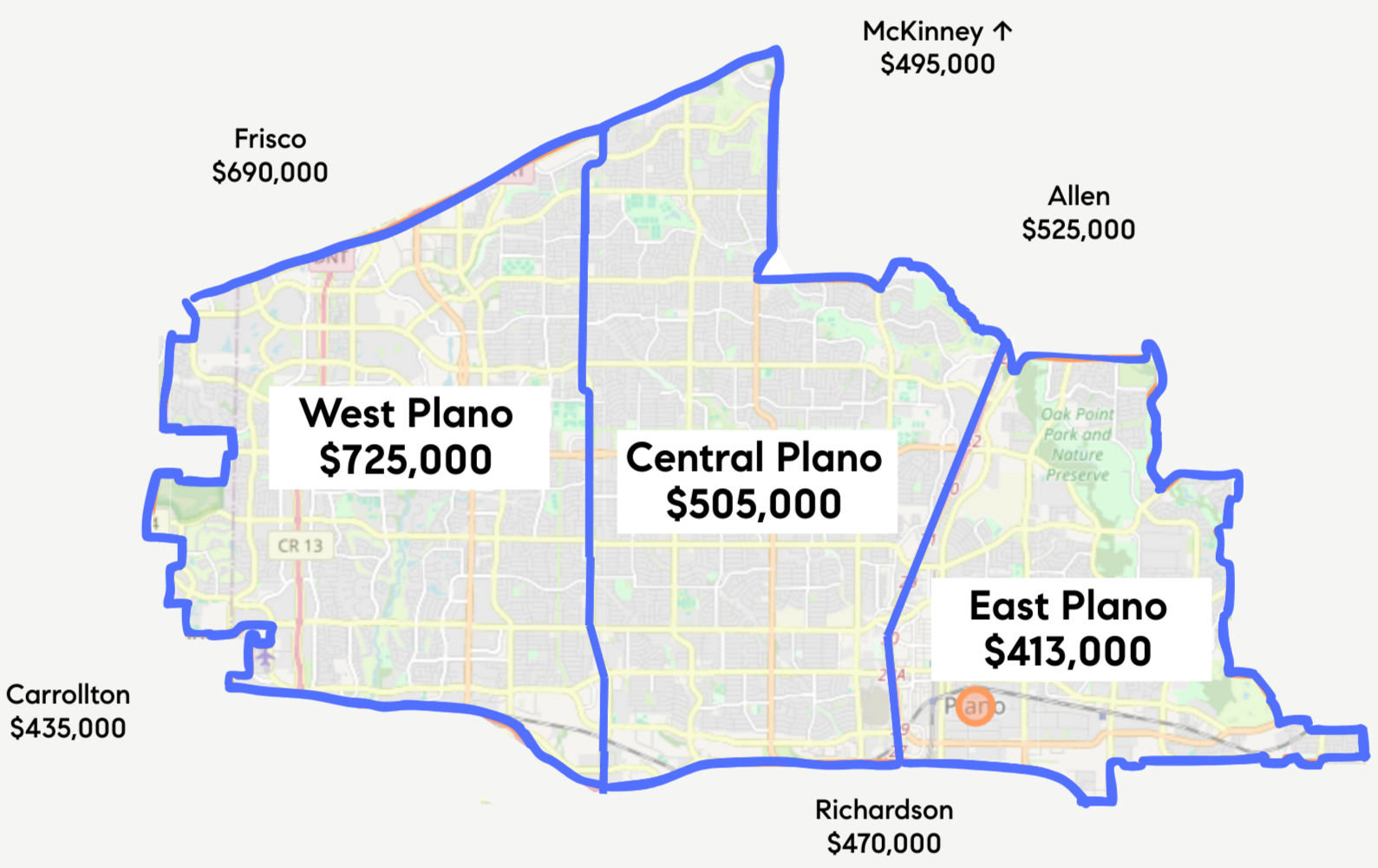

Geography & Competition

Plano doesn't compete with itself. Your real competition depends on where in the city you're selling—and what price point you're in. East Plano buyers cross-shop McKinney and Allen. West Plano competes with Frisco and Prosper. Understanding this dynamic is essential for pricing strategy.

For market analysis, we divide Plano into three regions by zip code:

West Plano: 75093, 75024

Central Plano: 75023, 75025, 75075

East Plano: 75074, 75098

These boundaries roughly align with Plano's three senior high school attendance zones (West, Senior, East).

East Plano: The Value Play

Median: $413K | $203/sf | 29 DOM

East Plano represents the city's most accessible entry point—established neighborhoods from the 1970s-1990s offering excellent value while maintaining Plano ISD access. Properties here compete directly with Richardson ($466K median) and Garland ($310K median), positioning East Plano as a middle-ground option that offers Plano schools and amenities at a more accessible price point than Central or West Plano.

Location against Highway 75 with DART access makes this region particularly attractive to commuters working in Dallas or Richardson's employment corridors—competing along the same north-south transportation spine.

2026 outlook: The 626-home Lavon Farms development breaks ground in late 2026, but market impact won't materialize until 2027 and beyond due to phased construction. Additionally, new construction here will likely price 20%+ above current median ($495K+), pulling overall prices higher rather than competing with existing inventory. Against East Plano's base of nearly 13,000 existing homes, this represents gradual evolution, not disruption.

Central Plano: The Market Core

Median: $505K | $213/sf | 25 DOM

Central Plano is the city's geographic and demographic center, representing 54% of all transactions—the "typical" Plano buyer. This area balances maturity with relative modernity, offering homes from the 1980s-2000s with complete infrastructure and established amenities.

The sweet spot: value + accessibility. Central Plano competes with Allen ($524K) and McKinney ($495K), offering proximity to both Dallas and Frisco employment centers that many outer suburbs can't match.

2026 outlook: Stability prevails. While Collin Creek adds inventory (primarily townhomes), it's not material against Central Plano's 38,000+ existing homes. Established infrastructure and central location maintain pricing power.

West Plano: The Premium Position

Median: $725K | $241/sf | 25 DOM

West Plano commands the city's highest prices for proximity to Legacy Drive's corporate corridor, newer construction, and luxury neighborhood concentration. Despite being the smallest region by sales volume, West Plano generates the highest median prices and price-per-square-foot.

West Plano competes with Frisco ($685K median) and Prosper ($850K median) but offers what speculative growth cities can't: established luxury, proven corporate stability, and immediate access to Legacy employment. AT&T's consolidation of 5,000+ employees to the former EDS campus reinforces this employment density—providing sustained demand independent of future corporate relocation bets.

2026 outlook: Limited supply sustains premium positioning. Since 2020, West Plano has added roughly 600 homes across multiple developments—Icon at Legacy West (129), Prairie Commons (180), Commodore at Preston (104), Central Park on Preston (69), Mustang Square (100), and Northbrook Place (16). Against West Plano's base of 22,000+ existing homes, this represents measured growth, not transformation. West Plano's advantage: serving corporate demand that already exists, not betting on future growth.

📍 Want Neighborhood-Specific Analysis?

This report provides city-wide and regional analysis, but every Plano neighborhood has its own micro-market dynamics. Interested in detailed performance data for your specific subdivision?

→ Schedule a consultation to discuss your neighborhood's trends

The Cross-City Analysis: Plano vs. Frisco

Should I buy in Plano or Frisco in 2026?

This is the most common cross-city comparison I encounter—particularly for buyers considering West Plano versus Frisco. Years ago, Plano was the clear winner. Today, Frisco has narrowed the gap with aggressive development and new amenities, already exceeding Plano's median price ($685K vs. $540K) driven by newer, larger homes.

Personally, I still favor Plano's established character and exceptional parks system. But Frisco is genuinely competitive. Here's how they compare:

| Factor | Plano | Frisco |

|---|---|---|

| 2025 Median Price | $540,000 (stable) | $690,000 (-$6K) |

| New Construction Pipeline | Limited (~500 homes) | Massive (The Fields, Firefly Park, Lexington, The Grove, others) |

| Median DOM | 25 days | 35 days |

| Market Maturity | Established, proven | Growth mode but stabilizing |

| Corporate Base | Stable, diversified | Growing, newer |

| Risk Profile | Stability play | Appreciation bet |

Development Pipeline Reality

Frisco's aggressive building—Firefly Park ($2.5B mixed-use), The Mix ($3B mixed-use), Fields West (2,500 acres)—represents a bet on continued explosive DFW growth. If corporate relocations sustain and population influx continues, Frisco's supply expansion positions them well.

But there's risk: oversupply if absorption slows. Plano's measured approach—Collin Creek, Willow Bend redevelopment, Lavon Farms totaling ~750 homes—serves today's demand rather than 2028's projection.

The distinction: Frisco builds for the market they hope exists. Plano serves the market that already exists.

Matt's Take:

Frisco and Prosper are building for the market they hope exists in 2028. Plano is serving the market that exists today. If you believe DFW's growth story continues unabated, Frisco's bet may pay off. If you value proven demand and pricing stability, Plano's the safer play. I'm not bearish on Frisco—but I am realistic about what happens when supply outpaces absorption.

Geographic positioning, competitive dynamics, and development pipelines all influence value—but they don't determine success. What separates successful sellers from the 616 properties sitting in shadow inventory? Execution. The final section synthesizes everything into actionable strategy.

The Seller's Strategy—Precision Over Hope

| Days on Market | Sold vs Original List | Sold vs Last List | # of Sales |

|---|---|---|---|

| 0-7 days | 100.0% | 100.0% | 595 |

| 8-14 days | 98.7% | 98.8% | 246 |

| 15-30 days | 97.2% | 98.0% | 349 |

| 31-60 days | 95.4% | 97.8% | 429 |

| 61-90 days | 93.0% | 97.2% | 234 |

| 90+ days | 90.2% | 97.1% | 322 |

Excludes contracts written before January 1, 2025

Pricing Precision: The 10% Lesson

The 2025 data delivers a brutal lesson in pricing strategy.

Homes that sold within the first week achieved 100% of asking price. Properties that lingered 90+ days sold for 90% of original list. That 10-point gap represents $54,000 on Plano's median home—the cost of hope-based pricing instead of market-based pricing.

How should I price my Plano home in 2026?

The answer is deceptively simple: within 3-5% of what comparable homes have actually sold for in the past 60 days. Not what they're listed at. Not what Zillow estimates. Not what you need to net for your next purchase. What the market has proven it will pay.

Here's where most sellers go wrong: Texas is a non-disclosure state, meaning online sites show the last list price, not the actual sold price. Your neighbor's home shows "Sold: $550,000" on Zillow. The reality:

Started at $585,000

Reduced to $550,000 after 45 days

Sold for $535,000 (97% of adjusted price)

Netted $529,000 after $6,000 in concessions

The real comparable is $529,000, not $550,000. But most sellers price based on that misleading online number—and wonder why their home sits while "inferior" properties sell.

The market will force you to the right price eventually. The only question is whether you get there on day one (100% of asking) or day ninety (90% of asking).

Market Realities: Budget for Friction

Concessions are standard, not negotiable.

51% of Plano sales in 2025 included seller concessions averaging $6,000. As discussed in the Interest Rates & Affordability section, these credits increasingly fund rate buydowns that improve buyer qualification—making concessions a strategic tool, not a sign of weakness.

Budget 1-2% of your sale price for concessions when planning net proceeds. This isn't contingency planning—it's baseline expectation. Even properties selling quickly (0-7 days) included concessions 47% of the time.

Condition matters more in balanced markets.

When buyers had no alternatives, condition was negotiable—someone would overpay for potential. In 2026's market of selection rather than scarcity, deferred maintenance becomes a liability. The home with fresh paint, updated landscaping, and inspection-ready systems competes. The one with visible wear sits—or sells at a discount exceeding what improvements would have cost.

Professional presentation isn't optional anymore. It's table stakes.

The Adaptation Advantage

What happens if I overprice my house in Plano?

The 2025 shadow inventory story answers this: 870 unique properties came to market but failed to sell. Of those, 29% adapted—adjusted pricing, improved condition, or changed timing—and found success. The other 71% (616 properties) chose to wait.

The 29% who succeeded:

Reduced price to market reality (not token $5K cuts, but meaningful 3-5%+ adjustments)

Made condition improvements based on buyer feedback

Switched agents who brought better marketing or pricing strategy

Adjusted timing to less competitive seasons

The 71% who waited:

Hoped the market would come to them

Prioritized their financial needs over market reality

Are now your competition in 2026

Which group you join is a choice. The market doesn't care about your circumstances—only about your home's value relative to available alternatives.

Timing Execution: When Circumstances Allow

If personal circumstances give you timing flexibility, the Seasonality & Timing section outlines the strategic windows: Q1 offers first-mover advantage and fastest absorption, Q2 brings maximum exposure but maximum competition, Q3 targets motivated buyers with timing pressure, and Q4 provides lowest seller competition.

But this assumes flexibility. If you need to move for a job, growing family, or life change—list when you're ready and price it right. A well-priced home in December outperforms an overpriced home in April every time.

The Strategic Framework

2026 success for Plano sellers comes down to three principles:

1. Price within 3-5% of actual (not listed) comparable sales.

The market will force you there. Choose whether it happens on day one at 100% or day ninety at 90%.

2. Budget 1-2% for concessions and invest in condition.

These aren't optional costs—they're the price of competing in a balanced market.

3. Adapt when the market signals you're wrong.

29% of failed listings in 2025 recovered by adjusting strategy. Be in that group, not the 71% still waiting on the sidelines.

Matt's Take:

The hardest conversation I have with sellers is explaining that the market doesn't negotiate. It simply reveals what buyers will pay.

Here's what I tell people: you can't underprice a house in a dynamic market like DFW. If a house is priced 'too low,' it receives multiple offers and gets bid up to true market value. The fear of 'leaving money on the table' by pricing aggressively is misplaced—competitive pricing creates competition.

The 616 properties sitting in shadow inventory all believed they deserved more than the market offered. They might be right—but the market doesn't care about 'deserving.' It cares about comparative value. The sellers who succeeded in 2025 weren't the ones with the best homes. They were the ones with the most accurate pricing and the most willingness to adapt. That pattern continues in 2026.

Conclusion: 2026 Clarity

Plano enters 2026 from a position of strength. The stability that defined 2025—prices up while neighbors declined, sales volume exceeding both 2024 and 2023, absorption velocity faster than competing cities—reflects structural advantages that don't disappear overnight.

But strength doesn't guarantee success without strategy.

Shadow inventory will return. New construction will add supply. Rates may drop modestly. Each dynamic creates both opportunity and competition. Success in 2026 comes from understanding these forces: pricing within 3-5% of actual comparables, budgeting for concessions, timing strategically when possible—not hoping the market comes to you.

The buyers who act on life circumstances rather than rate speculation, who negotiate seller concessions for affordability, who recognize Plano's value relative to speculative growth in neighboring cities—they'll build wealth through informed decisions, not perfect timing.

Should I buy or sell in Plano in 2026?

The answer isn't "good time" or "bad time"—it's "right strategy for your situation." Every market has opportunities. But only for those who understand what's actually happening beneath the headlines.

This analysis represents market intelligence that drives successful decisions—data-driven clarity that separates strategic success from expensive lessons, not cheerleading or fear-mongering.

Understanding these dynamics separates strategic decisions from expensive lessons. Whether you're evaluating a purchase, timing a sale, or analyzing your neighborhood's specific trends—market intelligence matters.

About This Analysis

This outlook draws on 11+ years of Plano market data tracked through proprietary Power BI systems, analyzing 40,000+ transactions across all neighborhoods and price tiers. Analysis includes 2025 performance data, multi-year historical trends, and seasonal patterns spanning 2020-2025 via NTREIS MLS.

Explore the data yourself: Plano Market Data Archive

Work with Matt

Matt Haistings | Broker Associate, Compass

Market intelligence, not just market access.

Every home and situation is unique. The data provides context—your specific circumstances deserve personalized analysis.

Discuss Your Situation:

Schedule a consultation

Email: matt@haistingsre.com | Phone: 469.305.0750

Stay Current:

Ready to Buy?