The Hidden Cost of Selling: What Dallas Sellers Pay in Concessions (2025)

Quick Answer:

In Dallas-Fort Worth, 50% of home sales in 2025 include seller concessions averaging $6,000 (1.8% of sales price).Entry-level homes (<$400K) see concessions in 55% of deals averaging 2.2% of price, while luxury homes ($2.5M+) include them in only 17% of transactions. Homes on the market longer pay more - properties selling in the first week average $5,000 in concessions, while those sitting 90+ days average $7,300.

Key takeaway: Budget approximately $6,000 in seller concessions when calculating your net proceeds, and price aggressively to minimize this cost.

Want the complete 2025 DFW Market Intelligence Report with neighborhood-level data?

Download the full analysis →

What Are Seller Concessions?

Seller concessions (also called seller credits) are costs that you as the home seller agree to pay on behalf of the buyer at closing. Think of them as financial contributions that help buyers cover their closing costs, repairs, or other transaction expenses.

Common seller concessions include:

Closing costs (appraisal fees, lender fees, escrow fees,... buyers have plenty of fees!)

Credits in lieu of repairs discovered during home inspections

Prepaid property taxes and homeowners insurance

Mortgage rate buydowns (temporarily reducing the buyer's interest rate)

While seller concessions have always existed, their frequency and size have increased dramatically in recent years. Understanding how much to budget is now essential for any seller planning their move.

How Common Are Seller Concessions in Dallas-Fort Worth?

The data tells a clear story: seller concessions have become the norm, not the exception.

Based on analysis over 50,000 home sales this year in Dallas, Denton, Collin, and Tarrant County::

50% of all transactions now include seller concessions

This is up from just 29% average between 2015-2022

The increase has been particularly sharp in 2023-2025

This dramatic shift means seller concessions are no longer a special circumstance, they're something every seller should plan for when calculating their net proceeds.

The Trend Accelerated in 2025

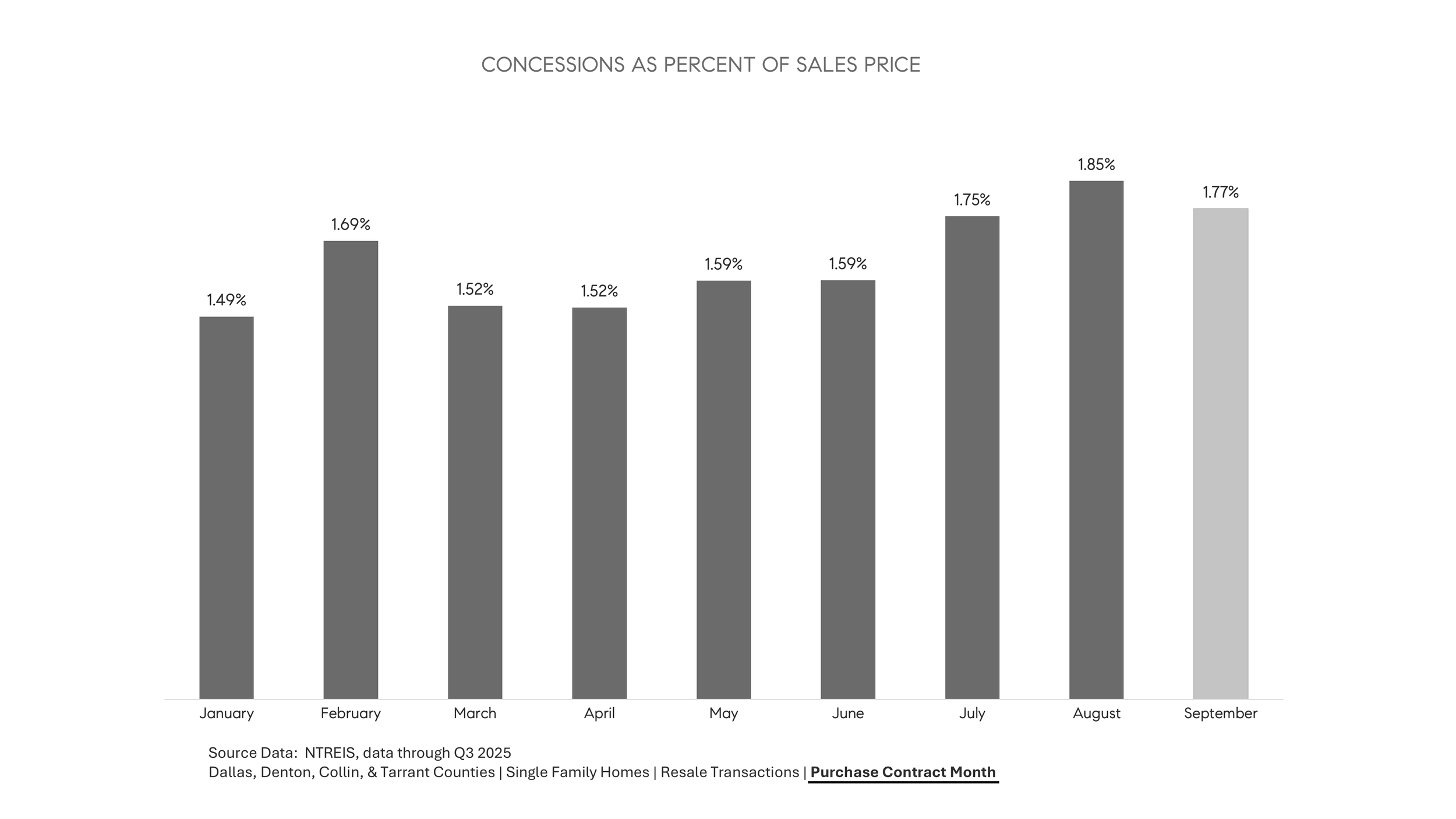

Monthly data shows the trend intensifying throughout 2025:

For current negotiations in Fall 2025, expect concessions in the 1.7-1.9% range.

How Much Should I Budget for Seller Concessions?

The median seller concession in Dallas-Fort Worth is $6,000, representing 1.8% of the sales price.

This $6,000 figure is critical for your net proceeds calculation. Many sellers are surprised at closing when they haven't factored this cost into their expectations.

Pro Tip: When your agent prepares a seller net sheet, make sure they include a line item for seller concessions at 1.8-2% of your expected sale price. This prevents unwelcome surprises.

Do Seller Concessions Vary by Home Price?

Absolutely. The frequency and percentage of seller concessions vary significantly across price tiers:

Entry-Level Homes (Under $400K)

55% of deals include concessions

Median amount: $6,250

Percentage: 2.2% of sales price

Mid-Market Homes ($400K-$1M)

48% of deals include concessions

Median amount: $5,614

Percentage: 1.1% of sales price

High-End Homes ($1M-$2.5M)

31% of deals include concessions

Median amount: $6,800

Percentage: 0.5% of sales price

Luxury Homes ($2.5M+)

17% of deals include concessions

Median amount: $14,000

Percentage: 0.4% of sales price

Key insight: Lower-priced homes face both higher frequency AND higher percentage impact. If you're selling an entry-level home, concessions should be a primary consideration in your pricing strategy.

How Do Days on Market Affect Seller Concessions?

Time is money - literally. The longer your home sits on the market, the more you'll likely pay in seller concessions:

0-7 days: $5,000

8-14 days: $5,500

15-30 days: $6,000

31-60 days: $6,663

61-90 days: $7,000

90+ days: $7,300

That represents a 46% increase in concession amounts between homes that sell in the first week versus those that linger beyond 90 days.

Why This Matters

This data reinforces a fundamental principle: smart, aggressive pricing from day one saves you money. Not only do you avoid price reductions, but you also minimize the concessions you'll need to offer.

A home that sits becomes stale. Buyers assume something is wrong, and they gain negotiating leverage. That leverage translates directly into higher concession requests.

How Do Price Reductions Affect Seller Concessions?

Sellers typically adjust their list price first, then face concession requests on top of those reductions.

The data shows:

First, sellers reduce price: Homes on market 90+ days sell for 90.7% of original list price

Then, they stabilize: After price adjustments, homes sell for 97-99% of their adjusted price

Finally, concessions are added: On top of the reduced price, sellers then offer concessions

This means the true cost of overpricing isn't just the price reduction—it's the price reduction PLUS larger concessions due to extended market time.

Do Buyers Who Ask for Concessions Pay More?

Here's the counterintuitive finding: Yes, buyers who request concessions typically pay 1-3% more for the home.

This means sellers often net similar or better amounts when offering concessions compared to deals without them.

Why Does This Happen?

Buyers asking for concessions are essentially requesting help with their upfront costs. In exchange, they're usually willing to pay a higher purchase price. This benefits sellers because:

Higher recorded sale price protects neighborhood values and future appraisals

Net proceeds are often similar once you subtract the concession amount

The sale closes faster because the buyer can afford to move forward

Example:

Without concessions: $500,000 sale price → Net proceeds ~$490,000

With concessions: $515,000 sale price - $6,000 concession → Net proceeds ~$499,000

The seller nets $9,000 MORE by offering the concession.

This is particularly true for homes with longer market times. At 90+ days, sellers offering concessions significantly out-perform those who don't.

How Do I Calculate Seller Concessions for My Home?

Use this calculator based on your home's price point and expected time on market:

How to Use This Calculator

Step 1: Identify your price category Step 2: Estimate your expected days on market based on current comparable salesStep 3: Find the intersection point for your percentage Step 4: Multiply your expected sale price by that percentage

Example:

$550,000 home (Mid-Market)

Expected to sell in 35 days

Look up: Mid-Market, 31-60 days = 1.16%

Calculation: $550,000 × 1.16% = $6,380 expected concession

This calculator is just one tool from our comprehensive 2025 DFW Market Intelligence Report. Get the full picture of pricing, timing, and negotiation strategies for your specific neighborhood.

Download the complete report →

Are Seller Concessions Better Than Price Reductions?

In many cases, yes - especially for the overall health of your neighborhood's real estate market.

Why Concessions Often Beat Price Reductions

1. Higher recorded sale price The sales price that gets recorded is the number the people focus on. Real estate agents use this data to establish comparable sales (comps) for future listings. A higher sale price, even with concessions, benefits your entire neighborhood.

2. Better appraisal support When your neighbor lists their home next month, their appraisal will be based partly on your sale. A $500,000 sale price supports their value better than a $485,000 sale, even if you netted the same amount after concessions.

3. Faster sales velocity Concessions help buyers overcome their biggest hurdle: upfront cash. By helping with closing costs, you remove a barrier to closing, which means your home sells faster.

4. Tax implications While you should consult a tax professional, seller concessions are typically treated as sales expenses that may reduce your taxable gain, similar to other closing costs.

When Price Reductions Make More Sense

Price reductions are the better strategy when:

Your home has been overpriced from the start

Comparable sales don't support your current price

You're competing against significantly lower-priced inventory

Buyers aren't making offers at all (indicating a price problem, not a terms problem)

Strategy: Consider price reductions FIRST to generate showing activity, then use concessions DURING negotiations to close the deal.

What's the Difference Between Seller Concessions and Rate Buy-downs?

Rate buydowns are a specific type of seller concession that has become increasingly popular as interest rates have risen. Rate buydowns are essentially a lender fee, which can be paid for with a seller concession. At closing, if the seller is giving the buyer a $10,000 credit, that will be applied to all of the buyer’s fees.

Standard Seller Concessions

Cover closing costs, repairs, prepaid expenses

Typically 1-2% of purchase price

One-time payments at closing

Help buyers with immediate cash needs

Rate Buy-downs

Temporarily reduce the buyer's mortgage interest rate

Typically 2-3% of the loan amount

Create lower monthly payments for 1-3 years

Help buyers qualify or afford higher monthly payments

Common Rate Buy-down Structures

2-1 Buydown:

Year 1: Interest rate reduced by 2%

Year 2: Interest rate reduced by 1%

Year 3+: Full rate applies

3-2-1 Buydown:

Year 1: Interest rate reduced by 3%

Year 2: Interest rate reduced by 2%

Year 3: Interest rate reduced by 1%

Year 4+: Full rate applies

Example: If a buyer qualifies for a 7% rate, a 2-1 buydown would give them:

Year 1: 5% (saving ~$400/month on a $500K loan)

Year 2: 6% (saving ~$200/month)

Year 3+: 7% (full rate)

Rate buydowns are particularly attractive in high-rate environments because they help buyers ease into their full payment while building equity or waiting for an opportunity to refinance.

Setting Realistic Expectations: Your Net Proceeds Calculation

When calculating your net proceeds from selling your home, include these line items:

Sales Price: Your expected sale price

Brokerage Commissions: Negotiable, but typically 5-7% of sales price

Title and Escrow Costs: Varies by transaction

Outstanding Mortgage Balance: Amount owed to lender

Repairs/Staging: Any pre-sale investments

Transfer Taxes: Varies by location

HOA Dues: Prorated amounts owed

✓ SELLER CONCESSIONS: Budget 1.5-2% of sales price

That last line is the one many sellers forget. Don't let it catch you by surprise.

Quick Estimation Formula

Conservative approach: Sales Price × 0.92 = Approximate net proceeds (Accounts for commissions, closing costs, and concessions)

Example:

$600,000 sales price

$600,000 × 0.92 = $552,000 approximate net

Subtract mortgage balance for your actual proceeds

Strategic Pricing in a Concession-Heavy Market

Given that concessions are now the norm, here's how to price strategically:

1. Price Aggressively From Day One

Every week on the market costs you money - both in price reductions and higher concessions. Start with your best price to generate immediate interest.

2. Factor Concessions Into Your "Must-Net" Number

If you need to net $400,000, don't list at $425,000. List at $435,000 to account for concessions.

3. Highlight Value, Not Just Price

If your home is in excellent condition and won't require repair credits, emphasize this in your marketing. "Move-in ready" homes can sometimes resist concession pressure. If you’re worried about property condition, then get an inspection first and disclose it to the buyer.

4. Be Prepared to Negotiate

Going in with a "no concessions" stance in today's market may cost you more in extended market time than the concession would have cost.

5. Use Concessions Strategically

If you receive multiple offers, concessions can be a tie-breaker. Offering to cover closing costs might win you a cleaner contract with fewer contingencies.

Frequently Asked Questions

What are seller concessions in real estate?

Seller concessions (also called seller credits) are costs that the home seller agrees to pay on behalf of the buyer at closing. In Dallas-Fort Worth, these typically range from $5,000-$7,000 and help buyers reduce their upfront expenses for closing costs, repairs, or rate buydowns.

How much are seller concessions in Dallas-Fort Worth in 2025?

The median seller concession in DFW is $6,000, representing 1.8% of the sales price. However, amounts vary by price tier: entry-level homes average 2.2% ($6,250), mid-market homes average 1.1% ($5,614), high-end homes average 0.5% ($6,800), and luxury homes average 0.4% ($14,000). The amount also increases with days on market—homes selling in the first week average $5,000 while those on market 90+ days average $7,300.

Do I have to offer seller concessions when selling my home?

No, seller concessions are optional and negotiated as part of the purchase contract. However, with 50% of DFW transactions now including them, it's wise to budget for the possibility in your net proceeds calculation. Whether to offer them depends on market conditions, how quickly you need to sell, and your competition.

Are seller concessions better than lowering my price?

Often yes. Data shows that buyers who request concessions typically pay 1-3% more for the home, meaning sellers often net similar or better amounts with concessions than without them. Additionally, a higher recorded sale price benefits neighborhood values and future appraisals, while concessions help buyers overcome upfront cash constraints that might prevent them from closing.

What's the difference between seller concessions and rate buydowns?

Seller concessions typically cover closing costs and repairs (1-2% of price), while rate buydowns specifically reduce the buyer's mortgage interest rate temporarily, such as a 2-1 buydown that lowers the rate by 2% in year one and 1% in year two. Rate buydowns require larger contributions—typically 2-3% of the loan amount—but create lower monthly payments that help buyers afford the purchase.

Can buyers use seller concessions for down payments?

No. Seller concessions can only be used for closing costs, prepaid expenses (like property taxes and homeowners insurance), repairs, and rate buydowns. Lenders prohibit using seller concessions toward the buyer's down payment or providing cash back to the buyer. These restrictions exist to ensure buyers have adequate equity in the property.

Do seller concessions cost me money or help me sell?

Both. You'll pay the concession amount out of your proceeds, but buyers typically pay a higher purchase price to offset this cost. Data shows sellers often net similar or better amounts with concessions versus without them. Homes with concessions also sell faster, and the higher recorded sale price benefits neighborhood values. The key is understanding concessions as a negotiation tool, not just a cost.

The Bottom Line:

Plan for Concessions

Seller concessions have evolved from rare exception to standard expectation. In Dallas-Fort Worth's 2025 market:

✓ 50% of transactions include concessions—factor this into your planning

✓ $6,000 is the median amount—a useful baseline for calculations

✓ Entry-level homes face higher costs—both in frequency and percentage

✓ Time on market drives costs up—every week matters

✓ Buyers who ask typically pay more—concessions don't always reduce your net

✓ Strategic pricing matters more than ever—get it right from day one

The sellers who navigate this market successfully are those who:

Price smartly to minimize days on market

Budget realistically for concessions in their net calculations

Use concessions as a negotiating tool, not a cost to avoid

Understand that a higher sale price with concessions often beats a lower price without them

Armed with this data, you can set accurate expectations and make informed decisions throughout your sale.

Ready to Sell with Confidence?

This analysis of seller concessions is just one component of successfully navigating the Dallas-Fort Worth real estate market. Understanding pricing trends, inventory levels, days on market benchmarks, and buyer behavior in your specific neighborhood is equally critical.

Download our complete 2025 DFW Market Intelligence Report for comprehensive data on:

Neighborhood-level pricing trends and appreciation rates

Inventory analysis by price point and location

Days on market benchmarks for your area

Buyer demographics and behavior patterns

Month-by-month market trend analysis

Strategic timing recommendations for sellers

Get the data-driven insights you need to price right, time perfectly, and negotiate successfully.

Download the Free 2025 Market Intelligence Report →

About This Analysis: This data is based on analysis of single-family home resale transactions in Dallas, Denton, Collin, and Tarrant Counties through Q3 2025, sourced from NTREIS (North Texas Real Estate Information Systems). The analysis includes thousands of 2025 purchase contracts to provide statistically significant insights into current market conditions.

Author: Matt Haistings | Connect on LinkedIn for regular Dallas-Fort Worth market insights

Last Updated: October 27, 2025