What Is Months of Supply in Real Estate? A Plano Buyer's and Seller's Guide

Real estate inventory can be hard to make sense of. When I tell you there are 24,000 homes for sale in DFW, is that a little or a lot? After all, DFW metro is a huge area with 7 million people. As a homeowner, you might see a couple of for-sale signs on your street and think there are more homes for sale than before, but it's still not a complete picture.

Here's the problem: unlike physical goods at a retail store, real estate inventory is spread out across an entire metro area. If a car dealer has too much inventory, their lot would be packed with cars, maybe even overflowing to an empty lot next door. You'd see it immediately. But homes for sale? They're just signs in random yards or pins scattered across a map in your browser window.

The real estate industry uses a metric called months of supply (sometimes called months of inventory) to solve this problem. It sounds a little nerdy, and honestly, I think this metric is lost on most people—and sadly, most agents too. Not to sound like a nerd (I'm not, I just write like one on the internet), but once you understand months of supply, you'll never look at the housing market the same way again.

What Months of Supply Actually Measures

Here's what months of supply tells you: at the current rate of sales, it will take X months for all the available homes to sell.

The calculation is straightforward. You take the number of active listings (homes currently for sale) and divide that by the number of homes sold in a recent period. I prefer to use last month's sales because that represents current demand, and lucky for us, DFW doesn't have a super seasonal market—it's relatively stable year-round.

The formula: Homes for Sale ÷ Homes Sold Last Month = Months of Supply

So if there are 1,000 homes for sale and the market averaged 250 home sales last month, you have 4 months of supply. At the current pace, it would take about four months for everything to sell.

Is It a Buyer's or Seller's Market?

Historically, the industry uses these guidelines:

Under 4 months of supply: Strong seller's market

4–6 months of supply: Balanced market

Over 6 months of supply: Buyer's market

But here's the catch: it really depends on who you ask and what market you're in. In DFW, we got so accustomed to ultra-low inventory during 2021-2022 that today's "4 months of supply" feels like a buyer's market to many people—even though historically, that would indicate sellers still have the upper hand.

Three Real-World Scenarios

Let me walk you through three examples to show you how this plays out in practice.

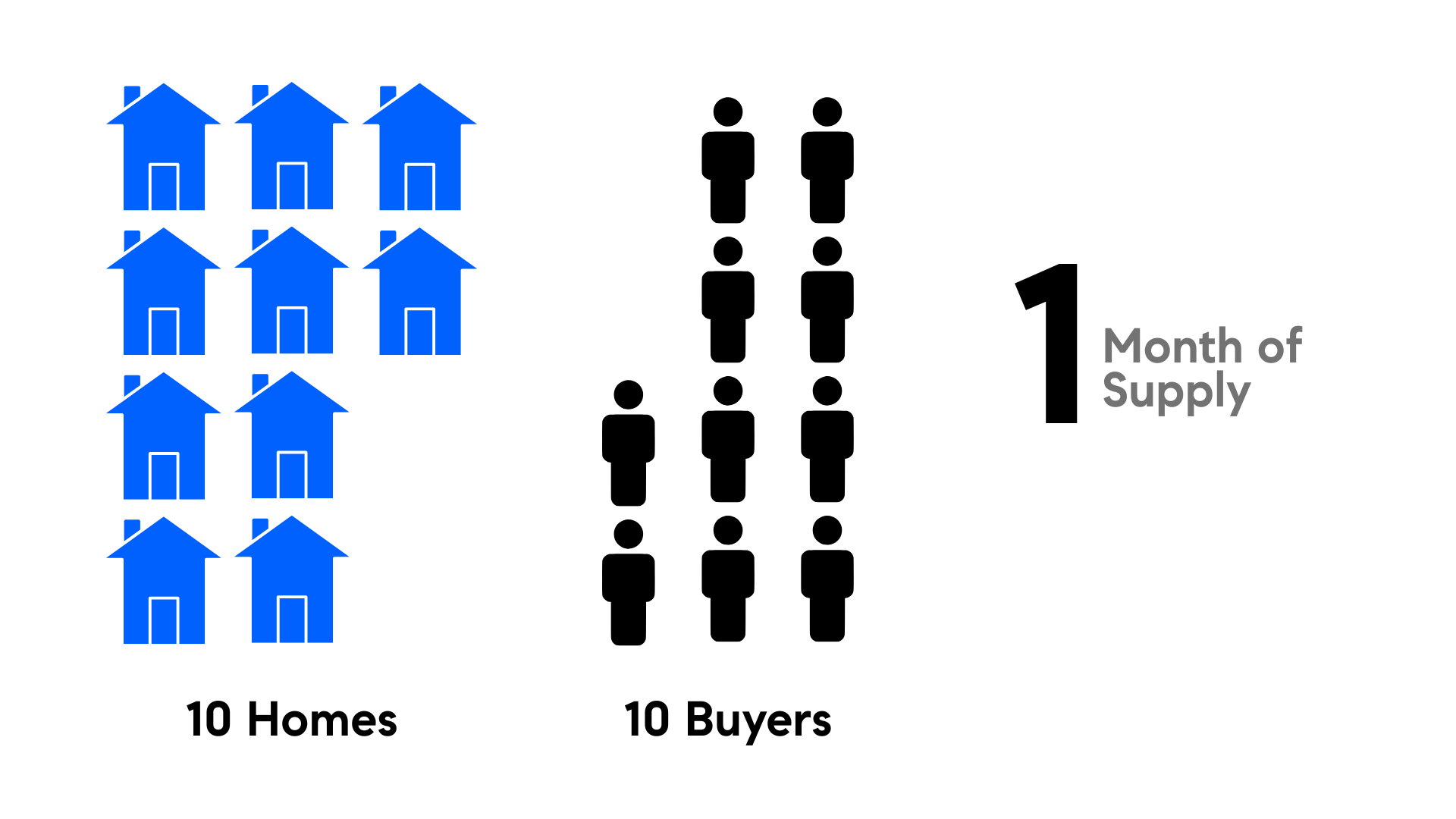

Scenario 1: Tight Inventory (Strong Seller's Market)

10 homes for sale

10 homes sold last month

Calculation: 10 ÷ 10 = 1 month of supply

This is a very tight market. If you think about it visually, all the homes would theoretically be gone in about a month if no new listings came on the market. Sellers have serious leverage here. Buyers are facing competition, possibly multiple offers, and they'll have limited negotiating power. This is the environment where buyers waive contingencies, offer over asking, and feel pressure to move fast.

Scenario 2: Healthy Inventory (Buyer-Friendly Market)

25 homes for sale

5 homes sold last month

Calculation: 25 ÷ 5 = 5 months of supply

Now we're in more of a buyer's market. Look at the visual here—there are lots of houses and relatively few recent buyers. Buyers have choices. They can take their time deciding. They can negotiate on price, ask for repairs, request closing cost assistance, and generally have more leverage. For sellers, this means being smart about pricing and understanding that you're competing not just with homes in your neighborhood, but potentially across the entire city.

Scenario 3: Extremely Tight Inventory (2022 Flashback)

5 homes for sale

15 homes sold last month

Calculation: 5 ÷ 15 = 0.3 months of supply

This was the reality for much of 2022 in DFW and across the country. There was massive demand and almost no supply. This is the environment where buyers were writing love letters to sellers, waiving inspections, and offering $50,000 over asking just to get a house. For sellers, it was an incredible time—homes would go under contract within days, often with multiple offers well above list price.

Why "Normal" Feels Like a Buyer's Market in DFW

Here's what's interesting about today's market: we got so accustomed to that third scenario—the 0.3 months of supply world—that when inventory crept back up to even 2 or 3 months of supply, it felt like the market had completely flipped.

People started saying, "It's a buyer's market now!" But the reality is more nuanced. Yes, buyers have more negotiating power than they did in 2022. Yes, sellers are increasingly offering concessions to close deals. But with 3-4 months of supply in many DFW markets, we're in a transitional phase - not the extreme seller's market of 2022, but not a true buyer's market either. Sellers still have leverage, they just need to be more strategic about pricing and presentation than they did two years ago.

It's a recalibration, not a reversal.

I also walked through these concepts in this video if you prefer to watch rather than read:

Market Segmentation: Different Stories Within the Same City

Here's where months of supply gets really interesting: when you look at it on a smaller, more granular level.

If you're looking at a relatively homogeneous neighborhood where home types and prices are pretty consistent—think Prosper's Windsong Ranch or a specific section of West Plano—then months of supply tells you a very specific story about that micro-market.

But if you're looking at an entire city like Dallas or Plano, the citywide "4 months of supply" number might mask dramatically different conditions at different price points:

Under $400K: Maybe 2 months of supply (strong seller's market)

$400K–$600K: Maybe 4 months of supply (balanced)

$600K–$800K: Maybe 5 months of supply (slight buyer advantage)

$800K+: Maybe 7 months of supply (clear buyer's market)

Now you're talking about different markets inside the same city. Different strategies apply. A seller at $350K might price aggressively and expect multiple offers. A seller at $850K needs to be much more strategic about pricing, staging, and timing.

The Bigger Supply Problem in Texas

I hate to admit it, but it took me a few years to fully "get" how important months of supply is in real estate. It really does come back to supply and demand—and with low supply, it doesn't matter how much demand exists if there's nothing to buy.

Nationwide, one of the long-term trends has been underbuilding. Not enough homes have been built over the past decade to keep up with population growth. In Texas, we compound that with strong natural population growth and massive in-migration from other states. It creates sustained pressure on inventory levels and keeps months of supply relatively low in most markets.

We saw the extreme version of this during the pandemic. Very few people wanted to sell, and there would be whole cities with just 100 homes on the market. That imbalance created the bidding wars and rapid appreciation we witnessed in 2021-2022.

What This Means for You

For Buyers:

Months of supply helps you set realistic expectations about competition and negotiating room.

In low-supply markets (under 3 months): Be prepared to move quickly, have your financing lined up, and understand you may face competition. Focus your negotiating energy on the most important items.

In higher-supply markets (4+ months): You have time to be selective. You can ask for price reductions, negotiate repairs, request seller concessions, and generally take a more measured approach.

Watch neighborhood-level data: A citywide stat might say one thing, but your specific neighborhood or price range could tell a completely different story.

For Sellers:

Understanding months of supply in your specific market segment is crucial for pricing and timing strategy.

In low-supply areas: You can price at or even slightly above market value and still generate strong interest. Condition matters, but pricing is less critical.

In higher-supply pockets: Pricing becomes crucial. You need to stand out through strategic pricing, excellent presentation, and being realistic about market conditions. Study your competition closely—not just what they want, but how your home compares to everything else a buyer could choose.

Timing matters: If you have flexibility on when to list, understanding seasonal trends in months of supply can help you maximize results.

Understanding Your Market Position

The next time you hear someone talking about months of supply or home inventory, you'll know exactly what they mean—and more importantly, why that number matters to your specific situation.

The key insight: months of supply isn't just a metric economists throw around. It's a practical tool that tells you how much leverage buyers or sellers have right now, and it can vary dramatically from one neighborhood to the next or one price point to another.

If you're looking to buy or sell a home in Plano or the North Dallas area, understanding these market dynamics is just the beginning. My team and I provide detailed market intelligence tailored to your specific neighborhood and price range—because a citywide statistic rarely tells the whole story.

Read our full Plano Market Report to see months of supply broken down by neighborhood and price segment, along with trend analysis and forward-looking insights.

Related Reading:

About the Author: Matt Haistings is a real estate broker associate with Compass Real Estate, specializing in the Plano and North Dallas market. He provides data-driven market intelligence to buyers and sellers throughout the DFW area.

This article was last updated November 2025.